- Maximalist

- Posts

- LVMH's Record-Breaking Performance in 2023 Amidst Global Challenges

LVMH's Record-Breaking Performance in 2023 Amidst Global Challenges

Welcome to the 22nd edition of the Maximalist! Dive into the ultimate guide, filled with insider insights into the world of fashion, art, real estate, travel, jewelry, and horology.

The world of luxury is never boring, and this week is no exception. Let’s dive in!

Markets

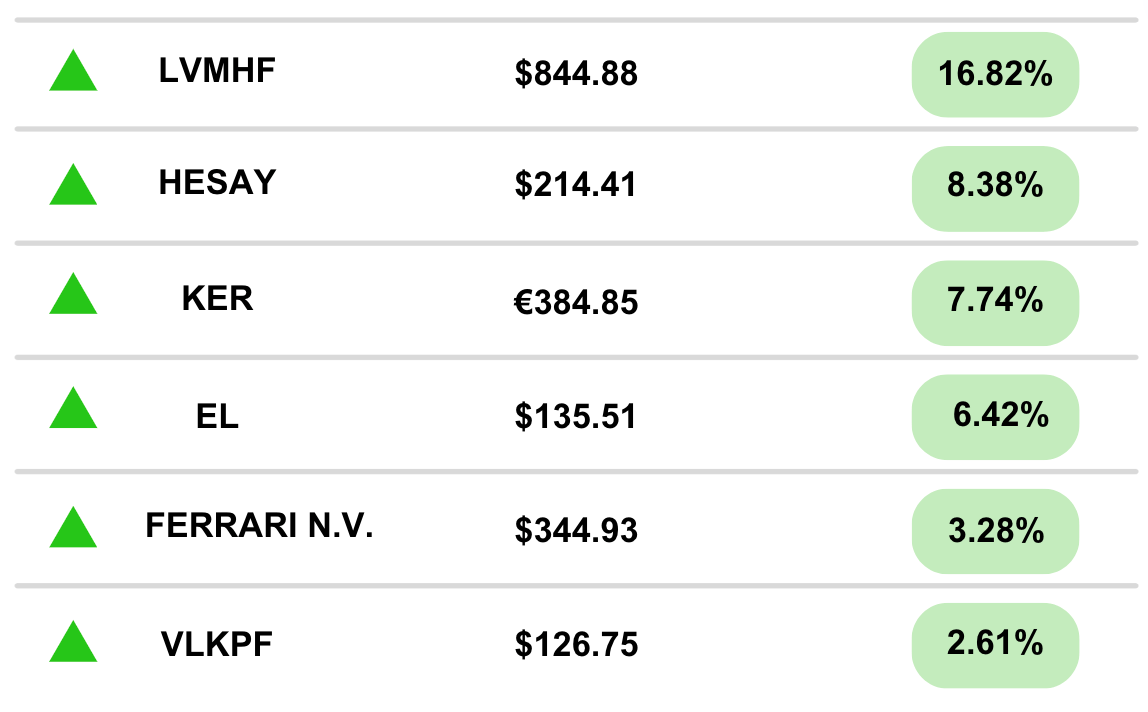

Values are as of market close on Monday, January 29, 2024, 4:00 p.m. ET. Percentages are based on stock performance over the prior 5 days

On this week’s agenda:

Investors Challenge Farfetch's Sale to Coupang Amidst Allegations of Undervaluation

Vestiaire Collective's Crowdfunding Drive and IPO Ambitions for 2025

LVMH's Record-Breaking Performance in 2023 Amidst Global Challenges

Couture Fashion Week SS24: A Fusion of Art, Technology, and Wearability

Jacquemus Spring 2024: A First Look at Fashion Week 2024

Investors Challenge Farfetch's Sale to Coupang Amidst Allegations of Undervaluation

A coalition of investors, known as the 2027 Ad Hoc Group, representing over 50% of Farfetch's institutional investors, is contesting the company's impending sale to South Korean e-commerce giant Coupang. The group, managing over $1 trillion, claims Farfetch's sale is significantly undervalued and lacks transparency.

The conflict arose following Farfetch's announcement that investors should not expect full recovery of their investments. In response, the Group declared Farfetch in default, demanding immediate repayment of 3.75% convertible senior notes due in 2027. They have appointed Pallas Partners and Ducera Partners as legal and financial advisors, respectively, to explore urgent alternatives before the deal's closure on April 30.

The Group criticizes the sale's terms, highlighting a 'poison pill' clause in the transaction support agreement that deters other potential bidders by imposing an additional $1 billion fee. This clause effectively makes Coupang's acquisition a bargain, preventing competitive, value-maximizing offers.

Concerns are also raised about Farfetch's rapid shift from a strong liquidity position in August 2023 to a distressed sale by December, with no clear explanation. The Group is exploring at least three credible acquisition alternatives, including a potential rescue effort by tech-investor Carmen Busquets.

Farfetch's CEO José Neves is criticized for losing focus on the core business, pursuing acquisitions and deals instead. Despite valuable assets like luxury boutique Browns and sneaker brand Stadium Goods, Neves's strategies have not matched the success of competitors like Mytheresa.

The Group is determined to protect their investments and explore other options for Farfetch, increasing pressure on both Farfetch's management and Coupang to justify their arrangement. The situation underscores the challenges in the online luxury marketplace sector and the complexities of corporate acquisitions.

José Neves

Vestiaire Collective's Crowdfunding Drive and IPO Ambitions for 2025

Vestiaire Collective, a prominent second-hand fashion marketplace, has initiated a crowdfunding campaign to raise at least one million euros ($1.09 million). This move is part of their strategy to become profitable by the end of 2024 and potentially prepare for an initial public offering (IPO) in 2025. The campaign, open to individuals over 18 in Europe and the UK, is being advertised on Vestiaire's website and mobile app.

CEO Maximilian Bittner views this crowdfunding as a marketing strategy to engage their loyal customer base more deeply by offering them a stake in the company. Each share is priced at 1.78 euros ($1.94), valuing the company at 1.1 billion euros ($1.20 billion), consistent with its valuation during a November funding round led by Eurazeo, its largest shareholder.

Despite a global slowdown in the luxury sector, Vestiaire Collective experienced a 25% sales growth last year. This growth is attributed to the increasing trend of purchasing second-hand clothes and accessories. The company, which profits from fees on sales of items like Gucci bags or Burberry trench coats, has positioned itself as a marketplace for desirable pre-owned fashion. Notably, since November 2022, it has banned the sale of over 60 fast fashion brands to focus on more sustainable and high-quality offerings.

Founded in Paris in 2009, Vestiaire Collective is backed by notable investors, including Kering, which owns a 5% stake, and Softbank. The crowdfunding campaign, managed through the UK-based platform Crowdcube, will officially start on February 6. This strategic move towards crowdfunding and an eventual IPO reflects Vestiaire Collective's confidence in its business model and growth trajectory in the evolving landscape of fashion retail.

LVMH's Record-Breaking Performance in 2023 Amidst Global Challenges

In 2023, LVMH Moët Hennessy Louis Vuitton, the world's leading luxury goods group, demonstrated remarkable financial performance, surpassing market expectations. The company achieved a significant 10% organic revenue growth in the fourth quarter of 2023, with full-year revenue reaching an impressive €86.2 billion. This marked a 13% organic increase from the previous year, exceeding industry estimates.

The growth was particularly notable in LVMH's selective retailing division, which includes prominent brands like Sephora and Belmond Hotels, witnessing a 21% increase in sales. This division's success contributed significantly to the overall revenue surge. The fashion and leather goods segment, a major revenue driver for LVMH, also saw a steady growth of 9%, consistent with the results in the third quarter.

LVMH's full-year operating profit rose by 8%, reaching €22.8 billion. The company experienced robust growth across all business groups, with the exception of Wines & Spirits, which faced a high comparison basis and high inventory levels. Despite these challenges, the champagne and cognac sectors showed resilience.

Bernard Arnault attributed this success to the exceptional appeal and innovative capabilities of LVMH's Maisons, which thrived despite a year marked by economic and geopolitical challenges. He emphasized the importance of the Maisons' ability to spark desire and maintain a high level of desirability among consumers.

Looking ahead, LVMH confidently enters 2024, supported by its strong brand portfolio and agile teams. The company is set to continue its growth trajectory, focusing on environmental sustainability, talent development, and preserving its heritage. A key highlight for the upcoming year is LVMH's partnership with the Paris 2024 Olympic and Paralympic Games, aligning with the group's core values of passion, inclusion, and striving for excellence.

Couture Fashion Week SS24: A Fusion of Art, Technology, and Wearability

The Spring/Summer 2024 Paris Couture Fashion Week was a vibrant showcase of creativity and evolution in high fashion. The event opened with a buzz around celebrity hair transformations, including Zendaya's new fringe at Schiaparelli and Rihanna's appearance at Dior. Simone Rocha's guest collection for Jean Paul Gaultier dominated social media with its reinterpretation of Gaultier's archives, featuring Breton tees made entirely of ribbons and Madonna-esque conical bras.

Daniel Roseberry's Schiaparelli collection pondered the intersection of AI and artisanship, symbolized by a robot baby carried by model Maggie Maurer. Armani Privé's collection, with its undulating, peplummed tulle gowns and extravagant headwear, was a playful nod to couture's fun side. Pierpaolo Piccioli's Valentino capes and ballgown skirts celebrated the joy at the heart of couture, focusing on the illusion of effortlessness.

Virginie Viard's Chanel collection brought a lightness with ballet-inspired designs, while Maria Grazia Chiuri's Dior collection emphasized wearability with cotton and moire pieces. The week also featured futuristic designs from Fendi, whimsical creations from Giambattista Valli, and punkish looks from Viktor & Rolf. Alaïa's collection, knitted from a single yarn, was a highlight, showcasing innovative craftsmanship.

Maison Margiela's theatrical show by John Galliano, featuring cinched pannier dresses and a diverse cast, concluded the week, emphasizing the need for inclusivity in couture. The event was a testament to couture's ability to marry artistic excellence with spectacle, celebrating individualism and innovation in high fashion.

Jacquemus Spring 2024

Simon Porte Jacquemus, at 34, firmly dismissed the idea of joining Givenchy, emphasizing his commitment to enhancing his own brand. His Spring 2024 Ready-to-Wear collection, showcased at the Maeght Foundation in Nice, was a testament to his unique vision. The collection, deeply influenced by modern art, particularly the works housed at the Maeght Foundation, reflected a blend of intelligence, culture, wit, and sensuality. It was rich in commercial appeal without compromising on creativity.

The show's invitation, a gray V-neck knit, symbolized Jacquemus's approach to transforming conventional fashion norms into innovative designs. This theme was evident in both menswear and womenswear, where traditional elements were reimagined in unexpected ways. The collection, predominantly monochrome with splashes of red, drew inspiration from artists like Alberto Giacometti and Joan Miró, integrating surrealism and modernism into the designs.

Jacquemus's signature rounded shoulders and playful distortions of the human silhouette were prominent, echoing Giacometti's sculptural style. The collection also featured accessories, including double-heel sandals, likely to go viral. The audience, a mix of celebrities and influencers, mirrored the collection's blend of high art and pop culture.

What did you think of today's email |

Thank you again for supporting the world of luxury.